Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

A teenager is heading out to spend over a thousand dollars on the latest smartphone. No judgment – we all love new tech. But here’s the crazy part: That same teenager is probably losing sleep over the $100,000+ in student loans they’re about to take on. Think about that for a second – we’ve normalized taking on six figures of debt before we can legally drink, but we haven’t taught our kids how to turn $1,200 into $85,000. Therefore, there is a great lesson to be learned and understood at any age.

When I was a kid, my father was one of the ‘buy now, pay later’ types and taught me that I should buy something because I deserve it. I’m sure you can see a problem here. But your generation? You’re smarter than that. You’ve watched your older siblings and cousins struggle with student loans. You know debt is a trap. What you might not know is how to flip the script.

Schools will teach you calculus, but not how to build real wealth. Today, that changes!

I’m about to show you something that could literally change the trajectory of your life. Not through get-rich-quick schemes, but through understanding how money really works. And trust me, once you see this, you’ll never look at that $5 daily coffee the same way again.

What does $100,000 really means in 2025? It’s not lottery money anymore – it’s your foundation. It’s your launching pad. And here’s the thing most people don’t realize: Getting to $100,000 is the hardest part. After that? Money starts working harder than you do.

Let me show you what I mean:

Imagine two friends, Sarah and Mike, both 18. Sarah understands what I’m about to show you and Mike does not – he is unaware, like I was, or has made excuses.

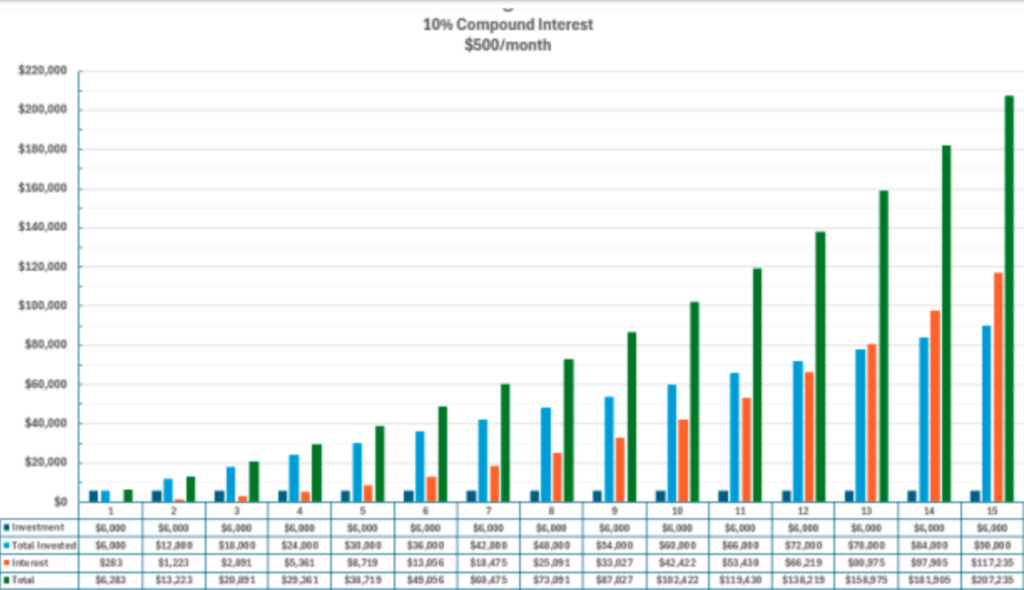

Sarah takes $6,000 from her part-time job and invests it. That’s $500 a month – yes, the same amount many people spend on car payments. She keeps doing this every year. At a 10% average return (what the stock market has historically done), guess what happens?

Now Mike? He’s doing what everyone else does. He’s waiting until he ‘makes more money’ to start investing. He’s focusing on buying the nice car, the latest tech, living the life he sees on Instagram. By 29, when Sarah hits $100,000, Mike has $0 invested.

Here’s the brutal math: If Mike starts at 28 trying to catch up to Sarah, he needs to invest $1,500 a month – THREE TIMES what Sarah was investing – just to reach the same goals. That’s the price of waiting. That’s the cost of following the crowd.

But where am I supposed to find $500 a month?’ I hear you asking. Let’s get real about this.

Pull out your phone right now. Open your banking app. I want you to look at the last 30 days of spending – really look at it. Most people are shocked to find they’re spending hundreds of dollars per month just on subscription services they barely use. Another $400-500 goes to random Amazon purchases and food delivery apps.

I’m not saying cut everything out. I’m saying get strategic. Here’s what Sarah did:

Just like that: $655 a month found. Not from living like a monk. Not from never having fun. Just from being intentional.

For now, let’s talk about the biggest obstacle you’ll face. It’s not finding the money. It’s not understanding the math. It’s psychology.

When Sarah started, her account grew by about $50 the first month. Felt like nothing. Meanwhile, her friend Mike’s new iPhone got 1,000 likes on Instagram. This is where most people quit. They can’t see that $50 turning into $100,000.

But here’s the secret Sarah understood: Wealth building isn’t linear. It’s exponential. Those first few years feel like you’re pushing a boulder uphill. But once you hit that $100,000 mark? The boulder starts rolling downhill, collecting speed and size on its own.

Sarah stuck to her plan when most people quit. Here’s her secret: She turned the invisible into visible. Every month, she looked at two numbers: The money she put in, and the money her money made for her. At first, it was depressing – her $500 investment might only earn $4 or $5. But she did something smart: She named that $4 her ’employee.’

‘This $4 is working for me 24/7, even while I sleep,’ she’d say. Next month, that ’employee’ brought a friend. Now $8 was working for her. Then $15. Then $25.

Let me show you exactly how this snowball picked up speed:

Year 1: Sarah invested $6,000 ($500/month)

Year 3: She’d invested $18,000 total

Year 5: $30,000 invested total

Year 7: $42,000 invested total

This is where it gets mind-blowing. By year 10, her $60,000 total investment turned into $10,000. That’s 70% more! By year 13, the interest alone is more than the investment amount and growing.

But here’s the real kicker – what happens next. In just the next five years, without Sarah changing anything about her $500 monthly investment:

See what happened there? The same $500 monthly investment that took 10 years to reach $102,000 now added another $105,000 in just 5 more years. That’s the power of compound interest – your money making money, which makes more money, which makes even more money.

By year 31, and close to retirement, you would be earning over $90,000 dollars per year, just in interest.

Finance like this is not taught in school, but knowing this opens a whole new world for a better life.

Check this out: When most people get their paycheck, they immediately think about what they can buy. That’s what we’re taught. But financially intelligent people? They think differently. Therefore, they ask questions like:

This is why some people seem to always have money growing, while others are always struggling, regardless of how much they make. It’s not about how much you earn – it’s about how intelligently you can solve money problems.

Now, here’s where it gets interesting. Once you develop this problem-solving mindset, you start seeing money differently and managing it accordingly.

Think about it like this: Every time you face a financial decision, it’s really a problem to solve. Should you buy or lease a car? Rent or buy a house? Invest in stocks or start a business? The better you get at solving these problems, the wealthier you become. This is what separates the financially successful from everyone else.

You might be wondering: ‘If it’s this straightforward, why isn’t everyone doing it?’ Let me show you three big wealth-killers:

Now, let’s talk about how to accelerate this growth. Because while Sarah’s story is powerful, it’s almost the bare minimum of what’s possible. Managing your own money can be far more profitable than leaving it in a bank. Financial knowledge and intelligence are everything.

Let me share what changed everything for me – something that takes the power of compound interest and puts it into overdrive. Remember that 10% market average we talked about? That’s what you get when you invest blindly. But what if you could participate in the market by managing your own money and following the big institutional investors and traders? The sky is the limit with some education.

Every single day, massive institutions – we’re talking hedge funds and investment banks – move billions of dollars through something called ‘dark pools.’ This is just a fancy way to get a large order filled without the retail trader being aware of it (if at all) until the order is filled. This is done because they don’t want to show their hand. Think about it – if everyone knew Warren Buffett was buying a stock, what do you think would happen to the price?

But here’s the game-changer: These trades leave footprints. And if you know how to spot them – if you can see where institutions are quietly building massive positions – you can potentially make much better returns than that basic 10%.

Remember Sarah’s journey to $100,000? Imagine reaching that goal in a few years instead of 11. This isn’t about day trading or staring at screens all day. It’s about making smarter, more informed decisions by following the real money.

Here’s what you need to do right now:

Remember: Financial intelligence isn’t just about saving money – it’s about spotting opportunities others miss. The institutions aren’t any smarter than you – they just have better information. Until now.

See you in the next video where we’ll dive deep into how dark pool trading really works.”