Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

In the fast-paced world of trading, having the right tools and insights can make a significant difference in your investment success. Understanding block trade indicators and dark pool prints is essential, especially for day traders, swing traders, investors, and newcomers to the market. These concepts not only offer insights into market movements but also help leverage platforms like Moby Tick Trading, known for utilizing real-time data and institutional trades from dark pools to highlight actionable trades quickly and efficiently.

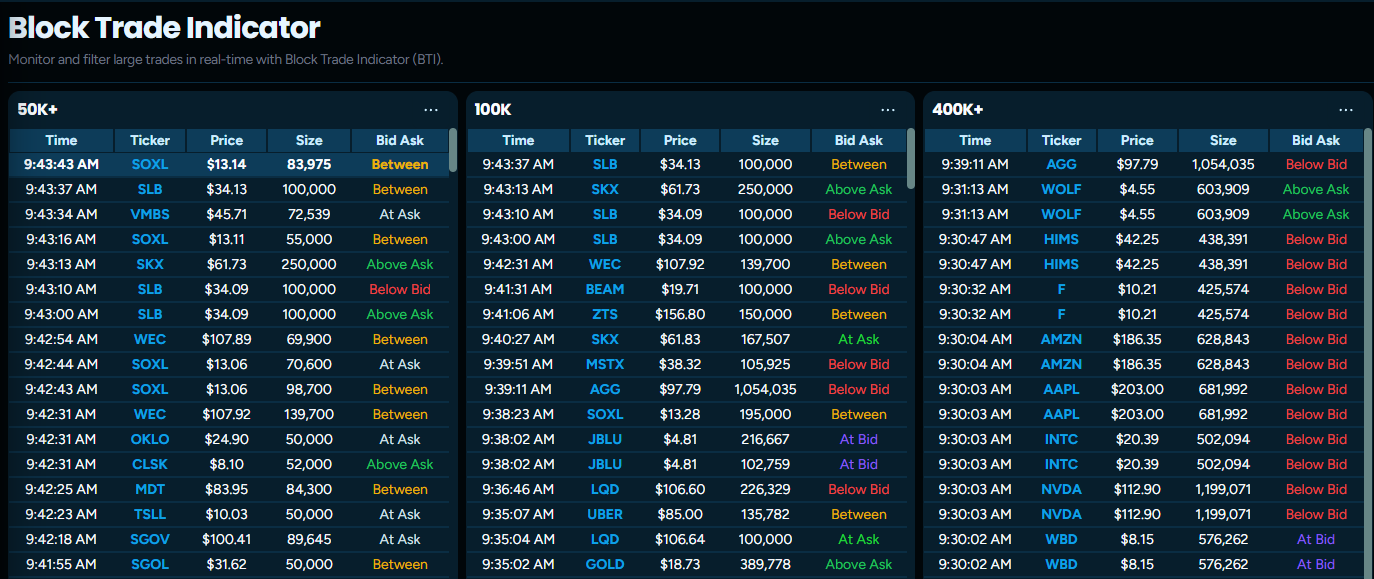

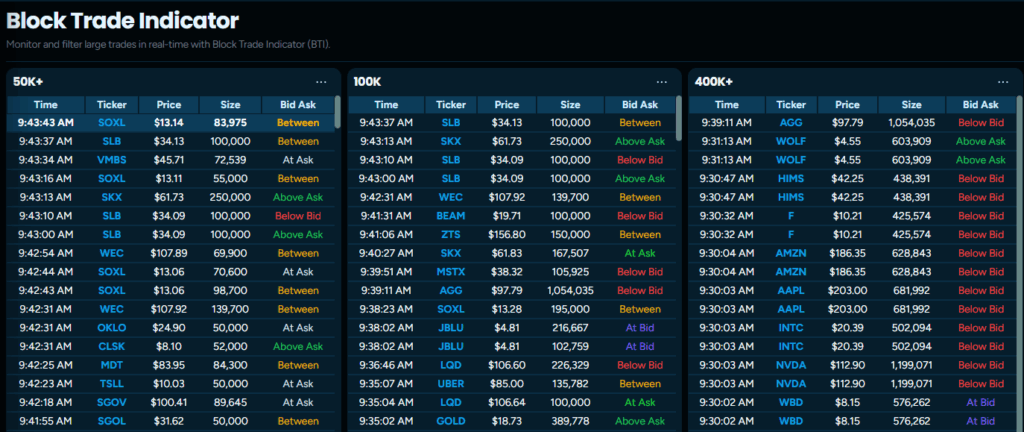

Block trade indicators are signals that highlight large-volume trades, often large enough to impact market prices. These trades typically occur outside the public exchanges, involving massive quantities of shares traded between entities, often institutional investors, to execute large transactions without causing significant price disruption in the market. Understanding these indicators can provide traders insights into big market movements and potential stock trends, as they reflect the interests and actions of significant market players.

Block trade indicators serve as a powerful tool for traders looking to understand the underlying movements within the market. They reveal patterns that may not be evident through traditional trading platforms. By monitoring these indicators, traders can potentially anticipate market movements, align their strategies with the trends, and make informed decisions. With platforms like Moby Tick Trading, traders can access these indicators seamlessly and filter actionable insights with minimal effort.

Dark pools are private financial exchanges where institutional investors trade large blocks of securities. These venues offer privacy and limited market impact since transactions are not visible to the public until after they are executed. Dark pools play a critical role in maintaining trading efficiency for large trades, preventing market volatility and minimizing the market’s reaction to sizable trades. However, for individual traders, understanding dark pool prints — the post-execution records of these trades — is crucial for getting a full picture of market dynamics.

Dark pool prints provide traders with clues about the market sentiment that might not be visible on the main exchanges. By analyzing these prints, traders can identify trends that align with or diverge from public market activity, offering a deeper insight into potential stock movements. For instance, if there is a high volume of dark pool activity in a particular stock, it could indicate a potential price movement incoming, especially if it coincides with block trade indicators.

Combining the insights from block trade indicators and dark pool prints allows traders to refine their strategies and potentially position themselves ahead of significant price actions. Moby Tick Trading provides a robust platform for integrating these elements effortlessly. By analyzing block trades and dark pool activity, traders of all levels can enhance their market analysis, making data-driven decisions that align with their trading goals.

The complex world of trading requires tools that simplify and enhance decision-making. Moby Tick Trading serves as an advanced stock screener, employing real-time data and large institutional trades from dark pools to deliver actionable insights swiftly. This technologically advanced platform is designed to streamline the trader’s process, focusing on efficiency and precision in identifying and executing profitable trades.

As the trading landscape evolves, the need to understand and utilize advanced indicators such as block trade indicators and dark pool prints grows paramount. These elements provide traders with an edge in deciphering market movements and executing well-informed trades. By incorporating these insights into a comprehensive trading strategy, and leveraging platforms like Moby Tick Trading, traders can navigate the markets more adeptly, ultimately enhancing their trading outcomes.

Embrace these advanced trading concepts to remain competitive in the ever-changing markets, and start exploring how tools like Moby Tick Trading can optimize your trading approach, making each investment decision more informed and strategic.

Utilizing these advanced trading tools and insights can provide traders an edge in navigating the markets and making informed decisions.