Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Every trader needs an edge, a system of making money consistently over time through thick and thin. During market rallies, everyone is a guru; throw a dart at a stock and you’ve beaten the market. The market then goes sideways, pulls back, and everyone has an opinion as to what the market is going to do.

Many traders have realized that the “news” doesn’t make sense. Analysts are quite often wrong (and make the worst traders). There are also the talking heads on TV that are pumping a stock, just for it to tank, or vice versa.

Understanding technical analysis and market structure is important as well as trading psychology. I would say that 85% of trading is psychology and the other 15% is analysis and following a trading plan. This aspect will be discussed later.

All traders have the same information available to them, as far as a blank chart is concerned. Trading is subjective, meaning some see a particular pattern and are bullish, while others are bearish. This is the crux of the market: buyers and sellers. Traders draw trendlines, mark support and resistance zones, and other confluences to make these determinations for themselves.

There are different classes of traders with varying degrees of experience, account sizes, emotional fortitude and success. There are also traders that fit into a separate category that trade institutional money, where massive positions are bought, sold and held for months, quarters or years. These wealthy traders and institutions have their own edge, strategies and advantages. The two top advantages institutional traders have is access to dark pool exchanges and being aware of the news before it happens.

The market is every man and woman for themselves. For a trader to win, someone else must lose. Enter the advantages of trading “smart money.”

Dark pool exchanges are perfectly legal and were developed to allow institutions to move massive amounts of shares without having to post their trade to the open market until the complete order is filled. Looking at this from a large trader’s perspective, if the trader is bullish on Apple (AAPL) and wants to buy one million shares and then placed a limit order on the open market, all traders would be able to see it. There is a slim chance the large trader would get filled at the price they wanted as everyone would jump in before this entry price was triggered, moving the market before the trader could get in. Retail traders would push the price of the stock up, leaving the institution unable to fill their order.

Because of this problem, dark pool exchanges were created. These exchanges have been around for decades but became more prolific in the 1990’s onwards along with technological improvements. Not only were institutional traders able to hide their trades until the order was filled, but they also received preferential pricing, which is far better than what is offered to retail traders. After institutions are already in their positions, retail traders then can see them, if they’re looking. Much better, right? Correct if you’re an institution.

Going back to the example of an institution placing a limit order on Apple in the open market at a specific price, traders would see this as support and a buying opportunity. It may not have been directly visible on the chart or through any technical analysis. What traders were then basing their decision to buy on was a massive order. Humans always need a reason for something to happen; it’s part of nature. In this case, whatever the reason, a large trader buying one million shares of AAPL at $256 (the price at the time of this article) would be $256,000,000.00. Perhaps this trader knows something that the retail trader does not? Many traders that follow dark pool trades tend to discover that the news comes later, after the institutions are already in their position. After all, if they want to buy all those shares, where are they going to get them from? Most likely, retail traders.

Even though retail traders could not see the trade as it was being filled, it does not mean that the price level is not a potential support or resistance zone (accumulation or distribution). There is a catalyst for a trade like this. Retail traders find out after the news has hit and are left chasing the stock with standard human emotions such as the fear of missing out and fear of losing money.

Knowing where institutions are buying and selling can be a critical part of trading analysis and can greatly increase return on investment (ROI). imagine spotting just one of these trades, finding a setup and being in a position already when the news hits? Other than an “ah ha” moment of “that’s why it moved,” you would be up quite a bit on your trade.

Here’s an example of a trade setup on United Health (UNH) following institutional trades rather than news and market sentiment.

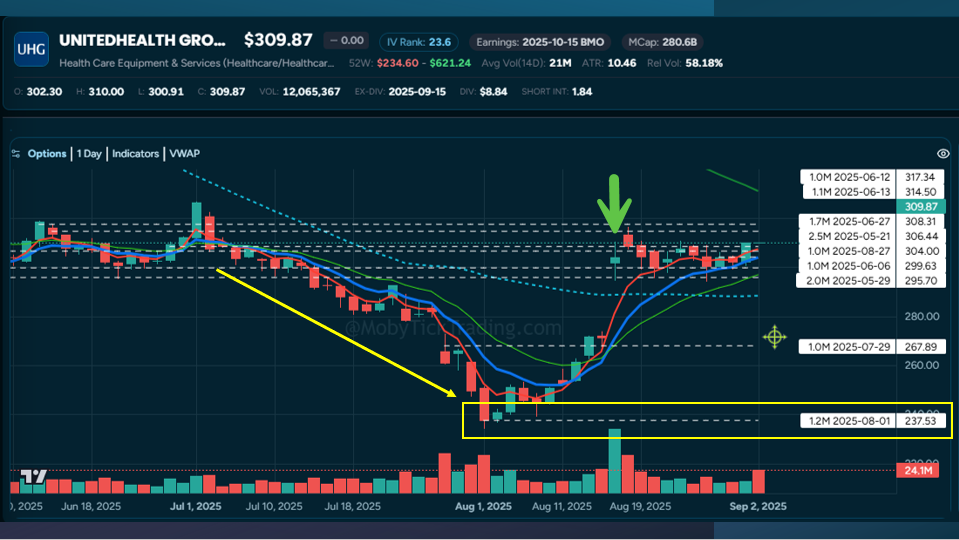

In the image below, notice the consolidation of massive block trades between 295.17-317.34 and the break below them on July 15, 2025 indicated by the yellow arrow. Also note the increasing volume with no wick on the bottom of the red candle. This was a great shorting opportunity as the institutions were finished accumulating their position. UNH closed that day at 291.71 and ran all the way down to 237.77 on August 1st, a $54 move.

July 29th, 2025 the news was very bearish for UNH.

August 1st, a 1.2 million share trade came in at 237.53 valued at $285,000,000.00

August 5th many traders entered this trade going long using call debit spreads risking $95 to make $905 per contract.

10 days later, on August 15th UNH gapped up $32.52 on positive news that Warren Buffet’s Berkshire Hathaway had invested $1.4-$1.6 Billion.

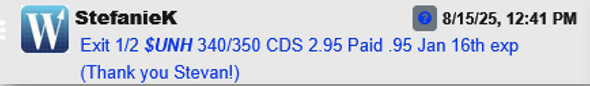

Traders started taking profits. Below, StefanieK exited half of her position capturing $200 per contract profit, a 310% ROI.

Psychologically, buying into the market with so much dismal news seems counter intuitive. If the consensus of retail traders is that the stock price will continue to fall, the fear aspect of trading indicates that traders should sell to avoid the pain of loss. For humans, two of the biggest fears are: being wrong and losing money. The negative news reinforces these fears and traders continue to sell. But, they sell into institutional positions that they are looking to buy. The retail trader loses out and the institution wins.

Being able to see institutional trades and positions is paramount to increasing profitability for retail traders and levels the playing field. Instead of fear, uncertainty or doubt (FUD), following institutional trade setups such as the $285M position in UNH allows traders to ignore the news and follow the true direction of the stock. It takes volume and commitment to move markets. Of course, there are always financial risks in trading.

Watching news and listening to talking heads is not terribly useful when behind the scenes hundreds of billions of dollars are being traded in dark pools and private exchanges. Watching institutional positioning is far more profitable and beneficial. There are applications that provide live and historical dark pool trade information such as Moby Tick.

With technology ever advancing, it has never been easier to get trade information like this with the click of a button. Over 40% of the US market trades in dark pool exchanges. Finding trades like our UNH example are easy to spot. Seeing these trades come through live is game-changing for traders.

If you are an options trader, what is your average ROI? Many traders that follow institutional money flows start taking some profit at 50%, 100% and higher. Of course, there will always be losses as that is the cost of doing business. No one can predict the market and nor do they need to. Traders need to win more trades than they lose. With higher ROI potential following the dark pools, accounts can grow quite quickly. It’s a matter of discipline, risk management and plan execution.

What if you could see hundreds of these opportunities all at once and take your pick? That information would be priceless. What if instead of reading the news after the fact, you were already positioned, taking profits into strength as other traders were covering their shorts?

It may be a worthwhile task to shake your head, clear your mind and take a good, unclouded look at the market. The difference between reactive trading and proactive positioning is the difference between following the crowd and leading it. This may be your red pill moment and the beginning of a new chapter in your trading journey.