Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

What if I told you that improving your win-rate by 1 in your trading could help you reach your profit goals 64.7% faster? In the next few minutes, I’m going to show you exactly how small tweaks to your win rate can dramatically accelerate your trading success – and I’ll break down the exact numbers to prove it. Plus, I’ll reveal how institutional money flow can be your secret weapon for finding these high-probability trades. If you’re tired of inconsistent results and want to transform your trading, stick around – this could be the game-changer you’ve been looking for.

Most traders track their win rates, usually out of 10 or a percentage. 7/10 or 70%, for example. Win rates can be a great measure of success, but does your Profit and Loss (P&L) reflect the same? You can have several great trades and blow it all in one or two trades.

The concept of risk is not new, but to truly measure profitability, we need to measure apples to apples, as they say. Risk is something that we can control and calculate our potential reward depending on our trading plans. Therefore, risk assessment is paramount, which is also capital preservation.

That said, most traders are looking for at least 1:1, 1:2, or 1:3 risk to reward. In the example below, we’ve set a risk of $50 per trade on a $5,000 account. This means that if we lose $50, we’re out of the trade. Our target is 1:3, so we are looking to take in $150 for our $50 risk.

Right away, you are limited to what you can trade due to our risk parameters. Highly volatile stocks may be immediately excluded since the chance of being stopped out is quite high. Most think of Return on Investment (ROI), but here we are going to flip the script and focus on Return on Risk (ROR).

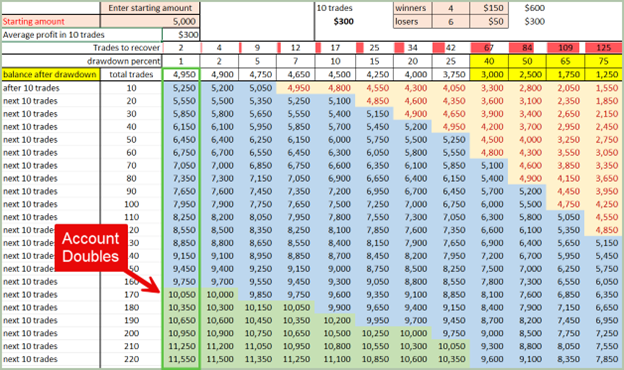

Let’s say we have 4/10-win rate (40%). Our risk is $50 per trade and our winners yield $150 per trade. We would have $300 is losses but $600 in wins leaving us $300 net over 10 trades. This is still profitable, and our P&L goes up over time.

In the table below, we will focus on the first colored column. With a starting balance of $5,000, our account would double in 170 trades, highlighted in green.

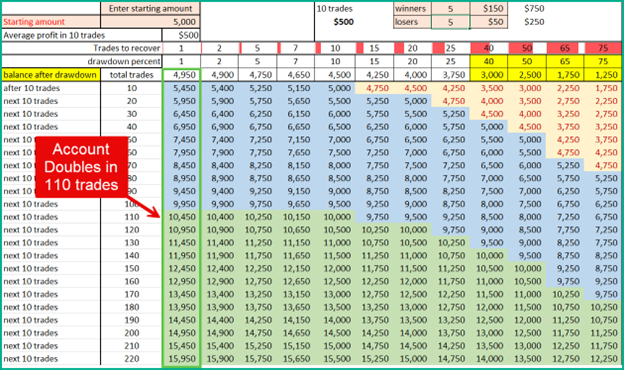

Let’s compare this by increasing our win rate to 5/10 (50%). In this scenario, we have eliminated one losing trade and gained a winning trade, increasing our $300 per ten trades to $500 per ten trades. That’s a 66% increase in profits and now, we are doubling our account in 110 trades rather than 170 which is 64.7% faster!

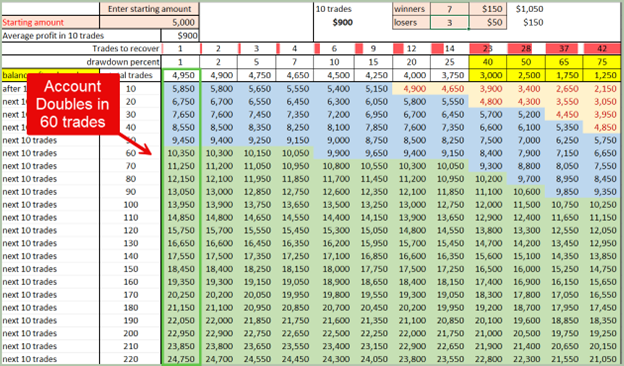

If we extend this to a 7/10 (70%) win rate then we are doubling our account in 60 trades which is almost 3 times faster than when we had 40% win rates. We are now averaging $900 in 10 trades instead of $500 per trade in the 6/10 example. In this scenario, we reach our goals 283% faster.

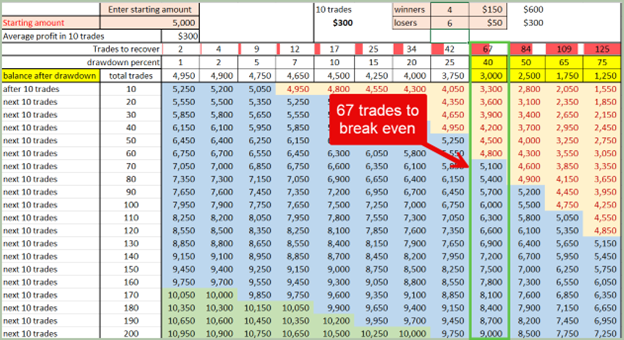

The table also provides some other astonishing information representing drawdowns and trades to recover. Many traders panic when they hit a 40% drawdown on their account as seen in yellow. The drawdown percent row indicates the current value of the trader’s capital in relation to the starting point.

Going back to our 40%-win rate example, if a trader is starting at a significant drawdown, such as 40%, the red section of the table indicates it would take 67 trades at this profit rate to reach break-even. Although this seems dismal, it is relevant information no matter how we feel about the fact.

What do I do if I’m in a position of a significant drawdown and my trading is not working out? First off, you need to determine the cause of your drawdowns and act accordingly to remedy it.

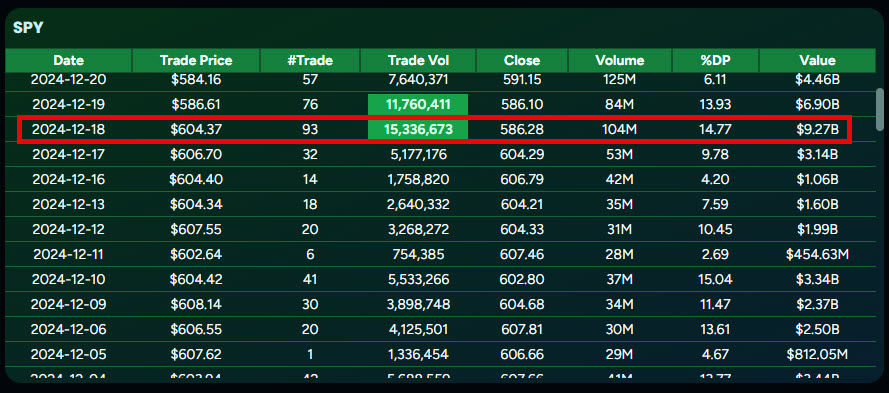

At Moby Tick, we focus on following the institutional players, tracking block trades that move the market. Seeing where these whale traders are buying and selling can have a massive impact on your profitability as we do not bet against them. It would be better to follow the trend set by these players instead. If you are unaware of these trades, it can be detrimental to your profitability.

Trading requires both education and experience. Humans are the cause of many of the psychological issues with trading, such as fear, greed, uncertainty and doubt. There is revenge trading, and our poor egos. The market cares not about these things and is completely oblivious to our existence, or our need for the money we are trying to make. Checking our emotions at the door is helpful but having a well-designed trading plan will help to alleviate the stresses traders put themselves unnecessarily. Learning more about trading psychology should be at the top of any traders’ list if they find themselves in this situation. How do you feel when you click the buy or sell button? Am I hesitating to get in or getting in late, missing most of the trade only to see it reverse when I get in then sell at the bottom? Revenge trading, anyone? These are all psychological behaviors that need to be addressed in order to improve your trading.

Journalling is paramount that doesn’t just include entries and exists, but also your emotional state, market conditions and the reason for getting in and out of each trade. Risk and reward are also very important as discussed earlier. These data quickly become historical and repetitive so you can see what needs to be improved.

A pre-trade checklist is also important. With a defined trading plan, you choose the best possible trade setups that fit your strategy. What are your confluences that must line up in order to take a trade? Does the trade meet your criteria for getting in? This helps to eliminate emotional trading and reduces the likelihood of entering low-probability trades.

Mastering risk management through proper position sizing as demonstrated, even a 40%-win rate can be profitable with the right return on risk. Never risk more than your predetermined amount per trade, regardless of how “certain” the setup appears.

Also, focus on the highest probability trade setups in your chosen timeframe. Rather than trying to catch every move, wait for trades to come to you. You do not control the market; it does its own thing. Trading is about the process. If you master the process, the money will come.

The right tools are important as every carpenter needs a good hammer. Moby Tick offers real-time institutional money flow alerts, one-click trade setup scanning, real-time block trades and other investigative tools to help traders find the most profitable trade setups in as few clicks as possible. For example, if we see a $9 billion trade on SPY and we close below that price level, it’s a good time to go short, therefore never arguing with the tape.

To find out more, visit us as MobyTickTrading.com to start your 7-day free trial. Also, follow us on YouTube for more educational content and daily stock trade callouts that you can profit from.