Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Day trading might sound like a high-stakes game best left to financial wizards, but with the right beginner tips and tools, even rookies can unleash their inner trader and thrive in the fast-paced market. Enter Moby Tick Trading, your new best buddy in the stock market sea, equipped with a treasure trove of advanced features designed to make your trading journey smoother than a dolphin’s glide. With Moby Tick’s intuitive stock screener, you can navigate market nuances and uncover top trade strategies with just a few clicks, leaving more time for sipping coffee and less for scratching your head. Whether you’re curious about upcoming earnings, keeping an eye on the Economic Calendar, or diving into customizable watchlists, Moby Tick Trading transforms day trading from a daunting challenge into an exhilarating adventure. Let’s embark on this voyage together and set sail towards confident trading success!

Before diving into the exciting world of day trading, it’s crucial to grasp the fundamentals. Let’s explore some key beginner tips, learn how to navigate market nuances, and develop effective trade strategies.

Day trading success starts with a solid foundation. Begin by educating yourself on market dynamics and trading terminology.

Set realistic expectations and start small. Many beginners make the mistake of risking too much too soon. Instead, focus on consistent, small gains as you build your skills and confidence.

Develop a disciplined approach to risk management. Establish clear entry and exit points for each trade, and stick to them religiously. This helps protect your capital and keeps emotions in check.

Remember, patience is a virtue in day trading. Don’t feel pressured to make trades constantly. Sometimes, the best action is no action at all.

Lastly, keep a trading journal to track your progress and learn from both successes and failures. This reflective practice is invaluable for continuous improvement.

Understanding market nuances is like learning to read the ocean’s currents. It takes time, practice, and the right tools to master.

Start by familiarizing yourself with different market conditions: trending, ranging, and volatile. Each requires a unique approach and strategy. For instance, trend-following strategies work well in trending markets, while mean reversion tactics might be more effective in ranging markets.

Pay attention to market sentiment and news events. These can significantly impact stock prices and create trading opportunities. However, be cautious of overreacting to every piece of news.

Learn to interpret technical indicators and chart patterns. While they’re not crystal balls, they can provide valuable insights into potential price movements. Start with basic indicators like moving averages and relative strength index (RSI) before exploring more complex tools.

Remember, no single indicator or pattern is foolproof. The key is to use multiple data points to form a comprehensive view of the market.

Crafting effective trade strategies is an art that combines analysis, discipline, and adaptability. Here’s how to get started:

Identify your trading style: Are you more comfortable with high-frequency trades or longer holding periods? Do you prefer technical analysis or fundamental analysis?

Define your entry and exit criteria: What signals will trigger you to enter or exit a trade? Be specific and quantifiable.

Back test your strategy: Use historical data to see how your strategy would have performed in the past. This can help identify strengths and weaknesses.

Start with paper trading: Practice your strategy in a simulated environment before risking real money. This allows you to refine your approach without financial risk.

Continuously evaluate and adjust: Markets evolve, and so should your strategies. Regularly review your performance and be willing to make changes when necessary.

Remember, the best strategy is one that aligns with your personality, risk tolerance, and financial goals. Don’t be afraid to experiment and find what works best for you.

Moby Tick Trading offers a suite of powerful tools designed to enhance your day trading experience. Let’s explore the dashboard features, learn how to customize your trading environment, and discover ways to maximize opportunities with Moby Tick.

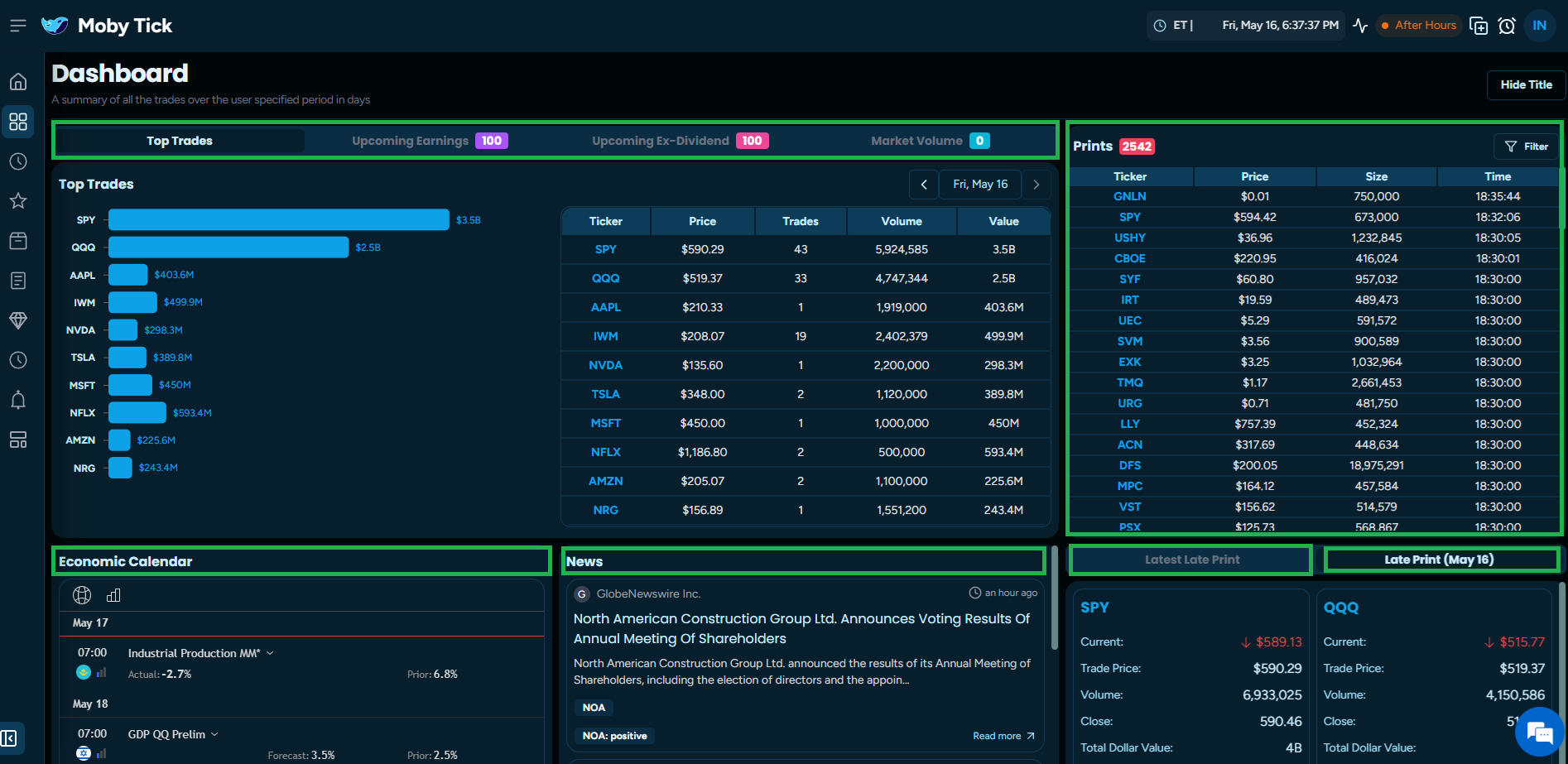

Moby Tick’s dashboard is your command center for navigating the markets. It’s packed with features to help you make informed decisions quickly.

The dashboard showcases potential top trades, giving you a head start on identifying promising opportunities. Keep an eye on upcoming earnings and ex-dividend dates to stay ahead of market-moving events.

The Economic Calendar feature helps you anticipate market reactions to important economic data releases. This can be crucial for timing your trades effectively.

Active prints and late prints provide real-time insights into market activity, helping you spot unusual trading patterns or potential breakouts. The Block Trade Indicator is particularly useful for identifying significant institutional moves.

With news wire integration, you’ll have access to market-moving headlines at your fingertips. This real-time information can be invaluable for making quick trading decisions.

Moby Tick understands that every trader is unique. That’s why they offer extensive customization options to tailor your trading experience.

Create personalized watchlists to keep track of your favorite stocks or sectors. These lists are fully customizable, allowing you to add your own notes, set alerts, and even export data for further analysis.

The customizable layouts feature lets you arrange your workspace exactly how you want it. Place your most-used tools front and center for quick access, or create multiple layouts for different trading scenarios.

Take advantage of the Time and Sales window to get a detailed view of individual trades. This can be particularly useful for identifying trading patterns or confirming price action.

The Trade Mapper feature provides a visual representation of your trades, helping you identify patterns in your trading behavior. This can be an invaluable tool for self-reflection and improvement.

Don’t forget to explore the ETF and Print lookup tools. These can provide quick insights into fund compositions and historical trade data, respectively.

Moby Tick’s advanced features are designed to help you uncover and capitalize on trading opportunities more efficiently.

The Opportunities feature presents lists of active stocks with significant volume and price movement. You can configure this tool to match your specific criteria, such as price range or bullish/bearish patterns.

Utilize the Seasonality tool to identify historical patterns in stock performance. This can be particularly useful for longer-term trading strategies or for anticipating cyclical market movements.

Take advantage of the Late Prints feature to spot after-hours trading activity. This can often provide valuable insights into potential price movements for the next trading day.

Remember to leverage the Block Trade Indicator to identify significant institutional activity. Large trades by major players can often signal important shifts in market sentiment.

By combining these tools effectively, you can create a powerful trading system that helps you spot opportunities faster and make more informed decisions.

Embarking on your day trading adventure can be both exciting and daunting. Let’s explore how to build confidence as a new trader, take advantage of Moby Tick’s free trial, and set meaningful goals to track your progress. Visit us at https://mobyticktrading.com/help

Confidence is key in day trading, but it must be built on a foundation of knowledge and experience. Here’s how to develop it:

Start with education. Immerse yourself in trading literature, attend webinars, and follow experienced traders. Knowledge is power, and in trading, it’s also confidence.

Practice extensively with paper trading. This risk-free environment allows you to test strategies and build confidence without financial stress. Treat it as seriously as you would real trading.

Start small when you transition to real trading. Early successes, even if modest, can significantly boost your confidence. Remember, consistency is more important than occasional big wins.

Learn from your mistakes. Every trader faces losses; what matters is how you respond. Analyze your errors, adjust your strategy, and view each setback as a learning opportunity.

Celebrate your successes, no matter how small. Recognizing your progress reinforces positive behaviors and builds confidence over time.

Moby Tick offers a 7-day free trial, providing an excellent opportunity to explore its advanced features without financial commitment. Here’s how to make the most of it:

Sign up at mobyticktrading.com and activate your trial.

Familiarize yourself with the dashboard layout and key features.

Set up personalized watchlists and explore the customization options.

Test different tools like the stock screener, Economic Calendar, and Block Trade Indicator.

Practice paper trading using Moby Tick’s real-time data and analysis tools.

Evaluate how Moby Tick’s features integrate with your trading strategy.

Take notes on which features you find most valuable for your trading style.

Remember, the goal is to determine how Moby Tick can enhance your trading process. Use this time to explore, experiment, and envision how these tools could fit into your daily trading routine. Check us out at https://mobyticktrading.com

Setting clear goals and tracking your progress is crucial for long-term success in day trading. Here’s how to approach it effectively:

Start by defining your overall trading objectives. Are you aiming for a specific monthly return? Looking to master a particular strategy? Be clear and specific about what you want to achieve.

Break down your larger goals into smaller, measurable milestones. For example, if your goal is to achieve consistent profitability, you might set milestones like “achieve break-even for one month” or “maintain a win rate above 60% for two weeks.”

Use Moby Tick’s tools to track your performance. The Trade Mapper and customizable watchlists can help you monitor your trades and analyze your results.

Regularly review your progress. Set aside time each week to evaluate your performance against your goals. Be honest with yourself about what’s working and what isn’t.

Adjust your goals as needed. As you gain experience and your skills improve, your initial goals may need to be updated. Don’t be afraid to raise the bar or shift focus as your trading evolves.

Remember, progress in trading isn’t always linear. Focus on long-term improvement rather than short-term fluctuations. With persistence, discipline, and the right tools, you can steadily work towards becoming a successful day trader.