Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

One good dark-pool setup routinely pays for an entire year of the tool — many traders in the room already proved it.

Check out the webinar replay here

If you’ve ever watched a stock gap 10–30% “out of nowhere” and thought, “Where the hell did that come from?”, you’re not alone.

The truth is simple: roughly 50% of all daily stock and ETF volume now happens off-exchange in dark pools and private venues — completely invisible to retail traders using normal Level 2, Time & Sales, or even most premium scanners.

That means the average trader is making decisions with only half the picture. But what if you could flip that unfair advantage back on the institutions? That’s exactly what Dave (founder of Moby Tick Trading) demonstrated in his latest live webinar — and the results speak for themselves.

Dave had his awakening in 2016 when he realized the market moves were too coordinated to be driven by millions of scattered retail traders. There had to be someone — or something — far bigger moving the chess pieces.That “something” turned out to be dark pool block trades — massive institutional orders (often millions of shares) executed privately so they don’t tip their hand on the open market.

Perfectly legal. Perfectly hidden. Perfectly profitable — if you know where to look.

Every single one of these moves was telegraphed weeks in advance — if you could see the prints.

So How Do You Actually Trade This Information?

Dave walked through live examples using the Moby Tick platform (spoiler: it takes literally seconds):

Attendees watched Dave pull up Apple in under 10 seconds:

→ 4.6 million-share print on Nov 12 at $273.47

→ Price now sitting pennies above it with increasing volume → high-conviction long setup.

Trader Testimonials from the Room

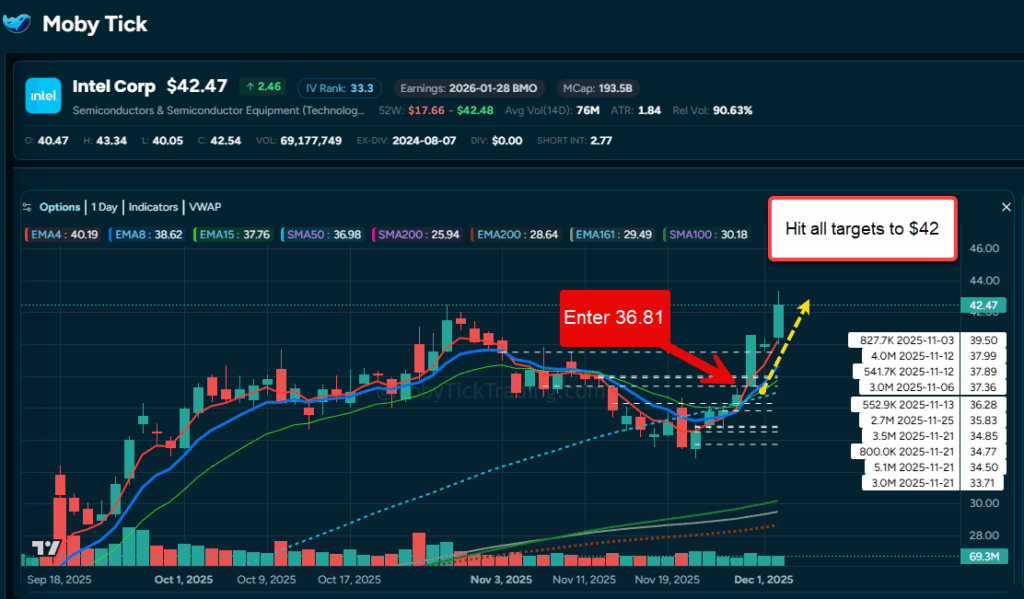

For anyone who joined the webinar last Tuesday, remember when Dave called out Intel ($INTC) as bullish above the dark-pool prints at $36.50? Well, it didn’t take long to validate.Entry around $36.81 → Stock powered through to over $42 in just 6 days. That’s a sharp 15%+ move on the underlying, with all targets smashed.The chart tells the story: Clean breakout above the key prints (including that 6.5M-share cluster), retest held, and off to the races with increasing volume. Institutions were stacking positions, and following their lead paid off big for those who entered.

Huge congrats to the traders who rode it — proof that spotting these prints early can turn a setup into quick, high-ROI wins.

Check out the full chart and details on our latest X post.

You will never eliminate the institutional edge completely — they have billions and lobbyists. But now, retail traders can see exactly where the elephants are stepping before the earthquake hits the public tape. And when you combine dark-pool prints with simple price action (retests, breakouts, consolidation, volume), the edge is absurd. As Dave put it: “Follow the money. Everything else is noise.”

Moby Tick gives you the tools to spot these opportunities in seconds — one good trade often covers the subscription for the year (many attendees have already done it in a single week). Link: https://mobyticktrading.com The market won’t give you a fair fight… but now you can at least see the whole battlefield.

See you on the inside,

— The Moby Tick Trading Team

P.S. We’re doing these live dark-pool webinars once a month. Follow us on our social media platforms below.