Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Timing is everything in trading. Miss a significant institutional block trade by even a few minutes, and you could lose your edge. That’s why we’re excited to announce the newest addition to MobyTickTrading: Block Trade Indicator Alerts.

This game-changing feature ensures you never miss critical institutional money movements, whether you’re actively monitoring your screens or focused on executing trades.

Picture this scenario: You’re in a position on SPY, actively managing your trade across multiple monitors. Suddenly, a 900,000-share dark pool print crosses for the same ticker. Wouldn’t you want to know about that immediately?

Or imagine you’re tracking a specific watchlist of stocks you’re considering for entry. An institutional player drops 400,000 shares on one of your targets. That’s actionable intelligence you need in real-time, not after the fact.

The new Block Trade Indicator Alert system solves exactly this problem. It transforms our powerful BTI into a proactive monitoring tool that works for you 24/7.

Before diving into alerts, let’s quickly review what makes our Block Trade Indicator so powerful. The BTI tracks over 10,000 stocks in real-time, automatically categorizing institutional block trades by size:

These customizable thresholds help you instantly identify the magnitude of institutional activity. Now, with alerts, you can be notified the moment these trades occur on your chosen stocks.

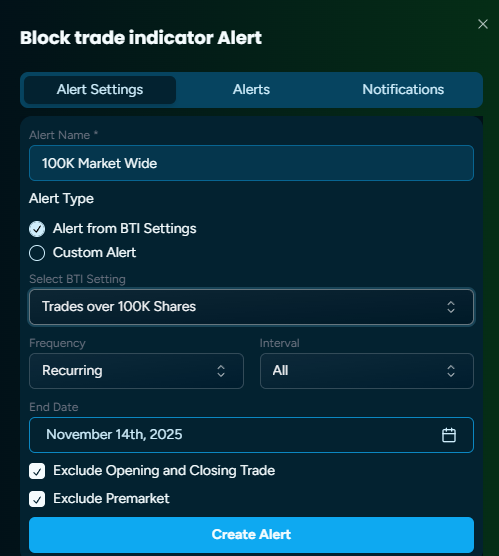

The beauty of BTI Alerts lies in its flexibility. You can configure alerts three different ways, depending on your trading style and focus.

Perfect for traders who want to monitor significant institutional activity across the entire market.

How to set it up:

Pro Tip: We recommend excluding opening prints at 9:30 AM and closing trades after market close. Opening prints often dump millions of shares in routine activity, and closing trades frequently involve ETF rebalancing that isn’t relevant for most trading strategies. These exclusions keep your alerts focused on meaningful institutional movements.

Use case: A market-wide alert set to 400,000 shares will notify you whenever any stock in our 10,000-stock universe sees institutional block trade activity above that threshold. This is ideal for discovering new opportunities you might not have on your radar.

Ideal for traders who maintain a curated list of stocks they’re actively trading or monitoring for setups.

How to set it up:

Use case: If you have positions in five different stocks or you’re watching specific tickers for entry opportunities, this alert will notify you the moment institutional money flows into any of those positions. This is particularly valuable for confirmation when you’re already in a trade or waiting for institutional validation before entering.

The most targeted approach, perfect for traders focused on specific instruments or sectors.

How to set it up:

Use case: Maybe you only trade mega-cap tech and major ETFs. Or perhaps you specialize in financial sector plays. Custom ticker alerts let you laser-focus on exactly the instruments that matter to your strategy.

Once your alerts are active, you’ll receive both audible and visual notifications whenever the criteria are met.

Visual Indicators: When a block trade matching your alert criteria occurs, you’ll see a purple banner notification appear on your screen. Each notification displays:

Audio Alerts: You’ll hear a distinct chime when alerts trigger, ensuring you catch important movements even when focused elsewhere on your workspace.

Managing Notifications: Click the notification icon to view your alert history. From here, you can:

This is especially useful if you step away from your desk and return to multiple notifications. You can quickly scan what institutional activity occurred in your absence.

All your configured alerts appear in the Alert panel, where you can:

Each alert clearly displays its configuration, so you always know what you’re monitoring and can adjust on the fly as your trading focus changes.

Here’s how BTI Alerts integrate into an actual trading workflow:

Many traders run several monitors in their workspace. The Block Trade Indicator with alerts typically lives on the top left monitor, positioned for peripheral vision monitoring. You’re not actively staring at it, but it’s there in your field of view.

When you’re managing an active trade, executing entries, or analyzing charts, that purple banner and alert chime cuts through the noise. You glance up, see the ticker and volume, and instantly have the information you need to make informed decisions.

Did institutional money just validate your entry? Is smart money taking the opposite side of your position? Are institutions accumulating the stock you’ve been watching? These questions get answered in real-time, without requiring constant manual monitoring.

Finding Your Share Threshold: Start with moderate thresholds and adjust based on your results:

Time Management: The default one-month duration works well for most traders, but you can customize this based on your trading schedule or specific campaigns.

Pre-Market and After-Hours: Consider whether extended hours activity is relevant to your strategy. Day traders might exclude these periods, while swing traders often want this data.

Block Trade Indicator Alerts transform passive monitoring into active intelligence gathering. You’re no longer hoping to catch institutional movements—you’re systematically notified whenever they occur within your parameters.

This means:

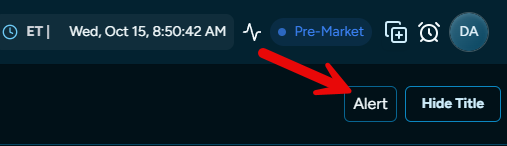

The Block Trade Indicator Alert feature is now live for all MobyTickTrading subscribers. If you’re already using the BTI, simply navigate to the Alert button and configure your first alert following the steps above.

New to MobyTickTrading? Our Block Trade Indicator is just one of nine powerful features designed to help you trade alongside institutions rather than against them. With over 10,000 stocks tracked in real-time and access to 5+ years of historical block trade data, you’ll have the institutional intelligence edge you need.

Ready to never miss another block trade?

Start your free 7-day trial at MobyTickTrading.com and experience the power of institutional-grade trading intelligence.

We’re constantly improving MobyTickTrading based on trader feedback. If you have questions about Block Trade Indicator Alerts or suggestions for additional features, email us at admin@mobyticktrading.com.

Happy trading, and may you always know what the smart money is doing.

About MobyTickTrading: We provide retail traders with institutional-grade dark pool and block trade intelligence. Our platform tracks over 10,000 stocks in real-time, revealing where smart money is positioning before it shows up in price. From the Block Trade Indicator to Print Lookup, Market Dashboard, and now BTI Alerts, every feature is designed to help you find the best trade setups in as few clicks as possible.